In this article

- Buying a Car Through Limited Company – is it Worth?

- Can a Limited Company Buy a Car?

- How to Choose the Right Vehicle

- How to Buy a Car Through Your Business

- Buying Electric Car Through Limited Company

- Alternatives to Buying a Car Through a Limited Company

- How to Claim Mileage and Fuel Costs

- Is Buying a Car Through a Limited Company Right for You?

Buying a Car Through Limited Company – is it Worth?

Buying a car through a limited company in the UK is a popular idea among directors, contractors, and small business owners. On paper, it looks pretty sharp, the company finances the purchase, covers maintenance, and there’s potential to lower the tax bill as well. It can seem like a win-win.

But it’s not just about getting from point A to point B or making a good impression when meeting clients. For a lot of business owners, it’s really about leveraging the business structure to save tax and putting the cost through the business instead of paying personally.

Of course, it’s not all upside. There are rules you need to be aware of. The company might be able to claim tax relief on certain expenses, such as fuel, insurance, and maintenance, sometimes reclaim VAT, and treat the car as a business asset. But HMRC pays close attention to company vehicles. If you’re using that car for personal errands, expect Benefits-in-Kind (BIK) tax charges, which can be significant. In fact, buying the wrong car through the business could actually cost you more.

Bottom line? It’s essential to carefully consider both the pros and cons before deciding if purchasing a car through your limited company actually makes sense for your situation.

Can a Limited Company Buy a Car?

Yes, a limited company can, in fact, purchase a vehicle, think of it as just another business asset. The company can buy the vehicle in its name, pay for it from the business bank account, and record it to the balance sheet. Sounds appealing, but, as with most business decisions, there are important legal and financial aspects to consider before moving forward.

New vs Used Cars

Your company can buy either a brand-new or a used car. Both options have their pros and cons.

New cars can deliver advantages like improved fuel efficiency, fewer maintenance concerns, and if you opt for a low-emission or electric model, potentially greater capital allowances. The downside? Higher upfront costs and more rapid depreciation.

Used cars, on the other hand, cost less to acquire, but may not offer the same tax relief or reliability, depending on their condition and age.

Buying vs Leasing

The method of purchase also deserves attention.

When deciding whether to lease or buy a car through your limited company, it’s important to weigh the pros and cons of both options. Each has its own tax benefits and financial considerations that can affect your business in different ways.

1. Benefits of Leasing a Car

Think of it as a subscription for a car; predictable costs, fresh wheels, and less risk. Here are some key benefits:

- Lower upfront costs: You’re not tying up a load of capital, which keeps your cash flow looking sharp.

- Tax advantages: Lease payments are generally tax-deductible, which can give your bottom line a nice little boost, especially if you’re actually using the car for business purpose only.

- No depreciation worries: Since you don’t own the car, you don’t have to worry about its value dropping over time.

- Easy upgrades: You get to upgrade to a new model every few years, keeping up that sleek, professional image.

2. Benefits of Buying a Car

If you want to build assets in your company, this is the traditional method. Here are some advantages:

- Ownership: The car’s yours, no ongoing payments once you’ve paid it off. It sits on your books, which can be handy for your balance sheet.

- Capital allowances: You get capital allowances for tax relief, and if you pick a low-emission model. Cars with lower CO2 emissions may qualify for 100% first-year allowances, meaning you can write off the full cost in the first year.

- No mileage restrictions: There’s no mileage police - drive as much as the business needs, without worrying about excess mileage fees.

3. Tax Treatment and VAT Reclaims

- Leasing: Lease payments are considered business expenses, so your company can deduct them from its taxable profits. However, only 50% of the VAT on lease payments can be reclaimed if the car is also used for personal trips.

- Buying: When buying, you can’t deduct the purchase cost directly. Instead, your company can claim capital allowances over time. The amount you can claim depends on the car’s emissions. You may also reclaim some or all of the VAT if the car is used exclusively for business.

4. Flexibility and Long-Term Costs

- Flexibility is where leasing shines, no big upfront payment, regular upgrades, and less hassle.

- Long-term, though? Buying often wins. Once it’s paid off, you’ve got an asset with no more payments hanging over your head.

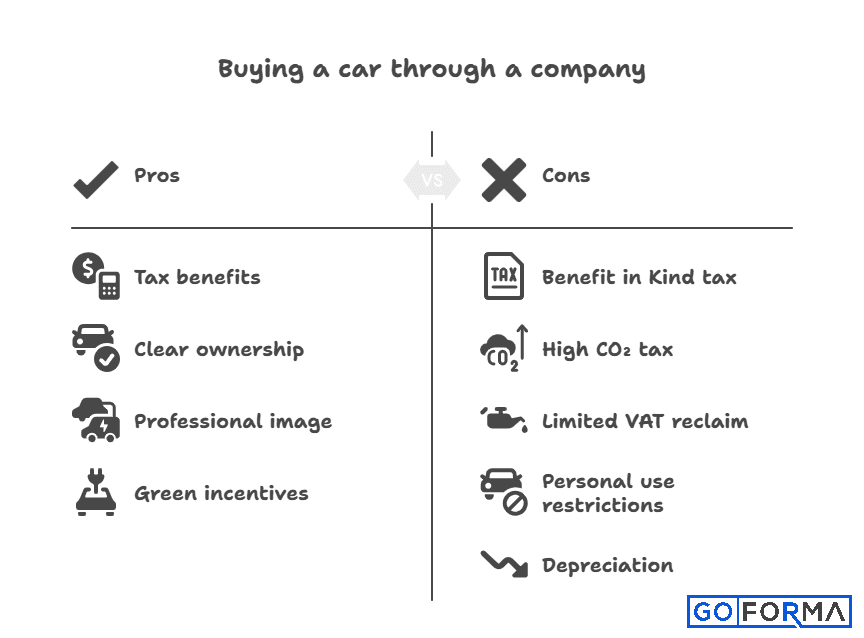

Pros of Buying a Car Through a Limited Company

Buying a car through your limited company isn’t just a practical move, it actually benefits in a numerous way if you’re mainly using the vehicle for business. Here’s why it might be a smart decision for your business:

1. Claim Capital Allowances

When your company purchases a vehicle, you’re allowed to deduct a part of that cost off your taxable profits. The amount depends on the car’s CO₂ emissions. Electric and low-emission models are the real winners here, often qualifying for the highest deductions, making them a more tax-friendly choice.

The available capital allowance for cars depends on the CO2 emission levels as below:

| Description of car | Claim |

| New and unused, CO2 emissions are 0g/km (or car is electric) |

100% first-year allowances |

| Second hand electric car | 18% WDA |

| New or second hand, CO2 emissions are 50g/km or less | 18% WDA |

| New or second hand, CO2 emissions are over 50g/km | 6% WDA |

Capital allowances allow you to deduct the cost of the car from your company’s profits over time. The type of capital allowance you can claim depends on the car's emissions:

- 100% First-Year Allowance: For electric cars or cars with very low CO2 emissions (50g/km or less), you can deduct the full cost of the car in the first year.

- Writing Down Allowance: For cars with higher emissions, you can claim a percentage of the car's cost each year (typically 18% for cars with emissions below 110g/km, and 6% for higher).

2. Reclaim VAT

If your company is VAT-registered, you can reclaim VAT on both the purchase price and running costs. Full recovery is only possible if the car’s strictly for business. If there’s any personal use, usually you’ll only be able to reclaim 50% of the VAT on lease payments. Still, for companies doing a lot of mileage, that’s a meaningful saving.

3. Clear-cut ownership

When you purchase the car in the company’s name, the car belongs to the business, all the expenses flow through the company bank account, and everything is recorded as part of your accounts. This keeps your business and personal finances cleanly separated, no awkward conversations with your accountant about who paid for which oil change.

4. Claim Business Expenses for Corporation Tax Relief

When you buy a car through your limited company, you can claim certain running costs as allowable business expenses. This includes:

- Fuel costs: You can claim the cost of fuel for business trips.

- Insurance: Business vehicle insurance premiums can be claimed as an expense.

- Maintenance and repairs: Regular servicing, repairs, and even MOT costs are all deductible expenses.

By claiming these expenses, your company can reduce your taxable profits and, in turn, your corporation tax bill.

5. Driving a professional image

A company car can also boost your professional image. Showing up to meetings in a smart, branded vehicle sends the right signals to clients and partners. In industries where presentation matters, this sort of detail can set you apart.

6. Green Cars, Bigger Perks

The government encourages businesses going electric, so there are generous tax breaks, low Benefit-in-Kind rates, potential grants, and even exemptions from certain road taxes or congestion charges. If you’re considering an electric company car, the numbers really start to look compelling.

Cons of Buying a Car through a LTD Company

A lot of directors see the tax benefits of buying a car through their limited company and think it’s a no-brainer. But, in reality, the drawbacks often outweigh the supposed advantages. Here’s where things get complicated.

1. Benefit in Kind (BiK)

Benefit in Kind (BiK) tax is a major factor. If you use the company car for anything beyond strictly business - yes, even commuting; HMRC treats it as a personal perk. The BIK tax calculation is based on the car’s list price and its CO₂ emissions. For petrol and diesel vehicles, this can mean a significant annual tax charge, sometimes enough to wipe out any company savings.

2. Higher Tax on Cars with High CO₂ Emissions

Emissions matter, too. The higher the CO₂ emission, the higher the BIK rate. Opting for a standard petrol or diesel car usually means a bigger tax bill than if you’d just bought it privately. Frankly, unless you choose an electric or ultra-low-emission car, it’s rarely a tax-efficient move.

3. Limited VAT Reclaim

VAT reclaim is another headache. The rules are strict: you can only reclaim the full VAT if the car is used solely for business, no personal use whatsoever. In practice, this is almost impossible unless it’s a pool car based at the workplace. Most directors can only reclaim VAT on running costs like fuel or servicing, and even then, it’s usually partial.

4. Restrictions on Personal Use

Any non-business mileage must be declared and documented. HMRC expects detailed records to distinguish between business and personal travel, which means more admin and less flexibility in how you use the car.

5. Depreciation: The Hidden Expense

Cars are notorious for losing value the minute you add them to your company’s ownership. That hit isn’t just theoretical; it shows up in your finances and reduces your car’s overall valuation, year after year. And if you ever try to sell that car? Selling it as a company asset is rarely straightforward. There’s extra paperwork, and you’ll likely to get a lower resale value than if you sold it as a private owner.

6. Higher Insurance and Running Costs

Company car insurance is usually more expensive than personal policies. On top of this, the business must pay for fuel, servicing, MOTs, breakdown cover, and road tax. Yes, some of these can be written off against corporation tax, but in practice, these “offsets” rarely balance out the outlay.

7. Administrative Burden

Managing a company car means extra paperwork such as reporting Benefits in Kind to HMRC, tracking mileage, handling VAT claims, and continually updating your accounts for depreciation and operating costs. For smaller businesses, this administrative workload can become a real drain on time and resources, sometimes outweighing any benefit the car brings.

How to Choose the Right Vehicle

1. Consider the Emissions

Low-emission vehicles often qualify for higher capital allowances and lower Benefit in Kind rates, making them a tax-efficient choice. So, it makes sense to know which emissions category your next vehicle falls into. Choosing wisely means you get both environmental cred and a more efficient tax position.

2. Usage and Purpose

Consider the primary use of the vehicle. If it's predominantly for business purposes, opting for a car that aligns with your business needs can maximise tax benefits. For example, vans receive different treatment to cars.

How to Buy a Car Through Your Business

Looking to purchase a car through your limited company? It can be a smart move, but only if you follow a clear process to avoid unexpected costs and HMRC issues. Here’s a simple step-by-step guide.

Step 1. Decide on purchase vs lease

Start by deciding whether your company will buy the car outright or lease it. Buying means your business owns the asset, which is useful if you intend to keep it long-term and want to claim capital allowances. Leasing, on the other hand, spreads your costs into predictable monthly payments and often includes maintenance. For electric vehicles, leasing is often more tax-efficient, since you avoid the headache of depreciation.

Step 2. Set a Budget

Analyse exactly what your company can afford to spend on a vehicle, not just the upfront cost, but ongoing expenses like insurance, maintenance, fuel, and any monthly payments if you’re leasing. Setting a clear budget now keeps things from spiraling out of control later.

Step 3. Research Vehicles

Look for cars that fit both your operational needs and your financial boundaries. Compare models, consider different fuel types, and check up-to-date pricing. Don’t overlook CO2 emissions, as it can have a direct impact on your company’s tax position and available benefits.

Step 4. Get Quotes

Whether you’re leaning toward buying or leasing, request quotes from multiple dealers and leasing companies. Carefully compare not just the sticker prices, but also the terms and any add-ons, like maintenance packages or warranties. Those extras can make a real difference in the end.

Step 5. VAT Reclaim—Are You Eligible?

If your company is VAT-registered, you might be able to reclaim VAT on the vehicle and running costs. Typically, businesses can only reclaim VAT on fuel, servicing, and repairs, and only for the portion used for business. It’s essential to check these rules upfront to avoid miscalculating savings.

Step 6. Understand Benefit-in-Kind (BIK) Tax

Benefit-in-Kind tax is a major consideration. If you or any employee uses the car for personal journeys including commuting, BIK tax applies. The rate is linked to the car’s list price and CO₂ emissions. Electric cars currently offer much lower BIK rates, making them far more attractive than petrol or diesel models. It’s important to calculate the annual BIK impact before finalising your decision.

Step 7. Consult with Your Accountant

Before you commit to anything, consult with your limited company accountant. Their expertise is crucial here, they’ll walk you through the tax implications and help you weigh the pros and cons of buying versus leasing through your company, based on your specific situation.

Step 8. Make the Purchase or Lease Agreement

Once you’ve made your choice and arranged financing, it’s time to finalise the paperwork. Read the contract thoroughly and make sure you understand all your obligations. If you’re leasing, double-check the agreement for duration and monthly payment details. Getting clarity here prevents problems down the line.

Step 9. Registration and Insurance

Once you’ve selected the vehicle, ensure it’s registered in the company’s name. You’ll also need to arrange business car insurance, personal policies won’t suffice. Business insurance can be more expensive, but it’s a legal requirement. The company will also be responsible for road tax, MOTs, and servicing.

Step 10. Keep records for HMRC

Accurate records are crucial. You’ll need to track:

- Business and personal mileage (for tax reporting).

- All running costs (fuel, repairs, servicing, insurance).

- VAT receipts if you’re reclaiming input tax.

- Any BIK charges reported through payroll.

Keeping your records organised will help you stay compliant with HMRC and analyse whether the company car is providing real value or becoming a cost burden.

Buying Electric Car Through Limited Company

Electric vehicles (EVs) have become an increasingly popular choice for directors and business owners looking for a tax-efficient company car. Forget about those old petrol or diesel models, EVs aren’t just good for the environment, they’re frankly a tax-saving machine.

Why EVs are tax-efficient

HMRC gives companies a much better deal on electric cars than on traditional ones. You can usually claim a full 100% first-year allowance, so you get to knock the whole cost of the car off your profits before calculating corporation tax. That’s instant tax relief you just don’t see with petrol or diesel.

Lower BIK rates for electric cars

Benefit-in-Kind tax is another area where EVs crush the competition. Because they don’t emit CO₂, the BIK rates are way lower. This means directors and employees using an EV as a company car pay much less personal tax than they would owe with a conventional vehicle. It’s a direct cut to your tax bill.

Government grants and incentives

The government’s been supporting the shift to electric with various grants and incentives. If you want charging points at your office, the government may help for that. While the grants for actually buying electric cars have mostly disappeared for regular models, there are still deals for vans and infrastructure. Plus, the reduced road tax (Vehicle Excise Duty) for electric cars adds another layer of savings.

Long-term savings compared to petrol or diesel

Now, sure, the upfront price tag on an electric car is usually higher. But running costs are consistently lower. Electricity costs less per mile than petrol, maintenance is cheaper (fewer moving parts, less hassle), and you can often avoid congestion charges in certain cities. When you tally up all the savings including the generous tax, Evs are more affordable over the lifetime of the car compared to a petrol or diesel equivalent.

Alternatives to Buying a Car Through a Limited Company

Buying a car through a limited company isn’t always the most tax-efficient or cost-effective choice. It really depends on how much you’re driving and whether it’s mostly for work or just personal runs. Let’s look at some of the most common alternatives.

Car Allowance

Instead of your company owning the car, some directors and employees prefer to take a car allowance. This is usually a set amount added to your salary each month to cover the cost of running your own car.

You pick the car, new or used, and you’re not boxed in by HMRC rules about what trips you can take. You’ve got full control. Downside? That allowance is treated like regular income, so it gets hit with Income Tax and National Insurance. Still, a lot of directors and employees prefer this option, it’s cleaner and often cheaper than dealing with Benefit-in-Kind tax on a company car.

Mileage Allowance

If you use your own car for business, your company can just pay you back through claim mileage allowance. HMRC sets the tax-free rates (currently 45p per mile for the first 10,000 miles each year, then 25p per mile after that).

This system works well if you don’t do huge amounts of business travel but still need to drive for client meetings, site visits, or other work trips. It avoids the complications of BIK tax, and you don’t have to worry about depreciation or resale value since the car remains yours personally.

Leasing through the Company

Leasing can be a middle ground between buying a car outright and relying on your own vehicle. The company pays a fixed monthly amount to lease the car, often with maintenance included, means fewer surprises for your budget. Leasing can sometimes be tax-efficient, especially for electric cars with low BIK rates. The company also avoids the risk of depreciation since the car goes back to the leasing company at the end of the term.

Quick Comparison - Company Car vs Alternatives

| Option | How it Works | Ownership | Tax Impact | Pros | Cons | Best For |

|---|---|---|---|---|---|---|

| Company Car | Business buys or leases car for director/employee use | Company | BIK tax on personal use (much lower for EVs) | Company pays costs, VAT reclaim possible, EV tax perks | High BIK on petrol/diesel, admin/reporting required | Directors using EVs, high mileage users |

| Car Allowance | Extra cash added to salary, employee sources own car | Employee | Treated as salary → Income Tax & NI apply | Flexible, no company admin, staff choose any car | Fully taxable, no business tax relief | Employees wanting choice/flexibility |

| Mileage Allowance | Employee uses own car; company reimburses business miles at HMRC rates | Employee | Tax-free up to 45p/25p per mile (above taxable) | Avoids BIK, no company car costs, low admin | No VAT reclaim or capital allowances | Occasional business drivers |

| Leasing (Company) | Company leases car (contract hire), pays running costs | Leasing company | BIK on private use, VAT reclaim possible | Fixed monthly cost, new cars, servicing included | Lease commitment, BIK still applies | Companies wanting predictable costs |

How to Claim Mileage and Fuel Costs

If you use a car for business purposes, you can claim mileage and fuel costs, which helps reduce your company’s taxable income. Whether the car is owned by the company or personally owned but used for business trips, understanding how to claim these expenses correctly is important for maximizing tax savings.

Claiming Fuel Costs for a Company Car

If your company owns the car, you can claim all fuel expenses for business trips as a business cost. This includes petrol, diesel, and even electric vehicle charging. However, it’s essential to separate personal use from business use.

For accurate claims, you’ll need to keep detailed records of your business trips, including the purpose of the trip, the date, and the number of miles driven. The company can reimburse you for fuel costs, and these can be deducted from your company’s taxable profits.

Claiming Mileage for a Personal Car

If you use your personal car for business trips, your company can reimburse you using mileage allowance. This allows you to cover fuel and wear and tear costs without having to go through complicated fuel claims. The UK government sets fixed rates for mileage claims to keep things simple:

| Vehicle Type | First 10,000 Miles | Over 10,000 Miles |

| Car, Van | £0.45/Mile | £0.25/Mile |

| Motorcycle | £0.24/Mile | £0.24/Mile |

| Bicycle | £0.204/Mile | £0.20/Mile |

Let’s understand with an example:

A freelance named John drives 12,000 business miles using a car, he can claim as below:

| First 10,000 Miles | 10000 * £0.45 = £4500 |

| For Remaining 2,000 Miles | 2000 * £0.25 = £500 |

| The total amount John can claim |

£4500 + £500 = £5000 |

The total business mileage is calculated for 12 months from 6th April to 5th April. The mileage clock restarts on 6th April each year.

Is Buying a Car Through a Limited Company Right for You?

Deciding whether to buy a car through your limited company isn’t exactly a simple yes-or-no situation. There’s a lot riding on your choice - the type of car you choose, how often you’ll use it for business versus personal journeys, and the overall tax impact.

At the moment, electric cars are pretty hard to ignore. Lower Benefit-in-Kind rates, plus you’ll likely save on running costs compared to petrol or diesel. But hey, if you’re constantly out on the road and can’t be bothered with charging stops every few hours, a traditional engine could still be the smarter pick.

Leasing? That’s on the table too, especially if you want to keep your cash flow flexible and avoid a big upfront bill.

Every company’ has got its own quirks, and what’s smart for one might be a headache for another. It’s best to consult with our accountant for limited company who can can help you weigh up the tax reliefs, running costs, and personal benefits, so you end up with the option that saves you money and fits your business, not just the latest trend.

FAQs on Purchasing a Car through Your Business

Is it better to buy personally or through a company?

It depends on your situation. Buying through your company may give tax advantages, especially with electric cars. However, for petrol or diesel cars, personal ownership can often work out cheaper once benefit-in-kind tax is considered.

Can I claim 100% VAT back on a company car?

You can only claim 100% VAT back if the car is used solely for business, with no personal use at all. In most cases, only 50% of the VAT can be claimed if there’s personal use.

What’s the most tax-efficient company car?

Electric cars are usually the most tax-efficient because they have low benefit-in-kind rates and qualify for more generous allowances.

Do I still pay road tax through the company?

Yes. The company will pay the road tax if it owns the car. It’s treated like any other running cost of the business.

Can I transfer my personal car to the company?

Yes, you can transfer your car into the company. The company would pay you the market value, but this could create a taxable benefit if you continue using it personally.

Is it worth buying a car through a limited company?

It can be worth it for electric cars or if the car is used mainly for business. For petrol and diesel cars, the personal tax costs often outweigh the benefits.

What is the most tax-efficient way to buy a car?

Using the company to buy an electric car is often the most tax-efficient route. For non-electric cars, buying personally may be more cost-effective.

Which cars qualify for 100% capital allowances?

Brand new, fully electric cars with zero emissions qualify for 100% first-year capital allowances. This means the company can deduct the full cost from profits in the first year.

Does a company car reduce your tax free allowance?

Yes, having a company car can affect your tax position. The car is treated as a benefit in kind, which increases your taxable income. This doesn’t change your personal tax-free allowance directly, but it does mean you pay more tax because HMRC adds the car benefit to your income.

.png)