In this article

Dividend Tax Rates 2025/26 – What You Need to Know

A dividend is money that's paid out by limited liability companies to investors, usually on a quarterly or annual basis. These payouts are based on the quarterly profits of your company as well as the amount of stock you own.

Dividends are calculated based on profits - what is left in your company after all expenses have been paid - not revenue.

Dividends can be either paid in cash or reinvested into your investment portfolio via dividend reinvestment, or via SCRIP dividends - which allow companies listed on the LSE to give investors additional shares instead of cash payouts.

Dividend tax refers to the rates by which those dividends are taxed according to HMRC. Each year, these tax rates may differ.

What is Dividend Tax?

Dividend tax, in a nutshell, is the tax on money you receive from company profits. After a company pays its bills and corporation tax, it can either reinvest its profit or pay out a portion to shareholders as dividends. If you’re on the receiving end, you might owe tax on dividends.

Who Pays Tax on Dividends?

Dividend tax applies to:

- Shareholders - anyone holding company shares and get a piece of the profits

- Limited Company Directors - many directors take a mix of salary and dividends as their income.

- Investors - individuals who earn money from shares in UK companies or overseas firms.

So, if you’re running your own business or investing in stocks, dividend tax could affect your personal income.

Dividends vs Salary Income

Dividends and salary are treated differently. Salary counts as employment income, so it’s hit with both Income Tax and National Insurance. Dividends, on the other hand, dodge National Insurance entirely, this is a big reason company directors find them tax efficient.

Worth noting that dividends aren’t a business expense. Even if the company has already paid tax on its profits, once you receive your dividend, HMRC treats it as your personal income. There are specific allowances and rates for dividend income, and anything you receive above your tax-free dividend allowance is subject to dividend tax.

UK Dividend Tax Rates 2025/26

In the UK, the tax you pay on dividends isn’t determined solely by your dividend income, it’s based on your total taxable income. After you’ve used up both your personal allowance and the dividend allowance, any remaining dividends are taxed according to the income tax band you fall into: basic, higher, or additional rate. So, your overall income sets the stage for how much tax you’ll owe on those dividends.

| Tax Band | Income Threshold | Dividend Tax Rate |

|---|---|---|

| Basic Rate | £12,571 – £50,270 | 8.75% |

| Higher Rate | £50,271 – £125,140 | 33.75% |

| Additional Rate | Over £125,140 | 39.35% |

Dividend Allowance 2025/26

The dividend allowance is the amount of dividend income you can receive before paying any dividend tax. For the 2025/26 tax year, the allowance has been cut to £500, a sharp drop compared to previous years.

This allowance has been reducing over time:

| Tax Year | Dividend Allowance |

|---|---|

| 6 April 2024 to 5 April 2025 | £500 |

| 6 April 2023 to 5 April 2024 | £1,000 |

| 6 April 2022 to 5 April 2023 | £2,000 |

| 6 April 2021 to 5 April 2022 | £2,000 |

| 6 April 2020 to 5 April 2021 | £2,000 |

| 6 April 2019 to 5 April 2020 | £2,000 |

| 6 April 2018 to 5 April 2019 | £2,000 |

| 6 April 2017 to 5 April 2018 | £5,000 |

| 6 April 2016 to 5 April 2017 | £5,000 |

This reduction means that, for most business owners and serious investors, the days of meaningful tax-free dividend income are pretty much over. Once you’ve used your personal allowance, nearly all dividend income becomes taxable.

In practical terms, the allowance shields the first £500 of your annual dividend income from tax. It doesn’t matter if you’re a basic, higher, or additional rate taxpayer, the rule applies across the board.

For instance, if you receive £2,000 in dividends this tax year, only £500 is tax-free. The remaining £1,500 is subject to dividend tax at your applicable rate. The bottom line? There’s not much room left to avoid tax on dividends, so planning ahead is more important than ever.

How Dividend Tax is Calculated

HMRC looks at your entire taxable income, not just your dividends. That means salary, self-employment, rental income, dividends, everything. It all gets sumed up together to determine which tax band your dividends fall into.

Step-by-step calculation

Step 1. Add up all your income

Total up all your income for the year. That’s your salary, any freelance or side gig earnings, rental income, and of course, your dividends.

Step 2. Apply your Personal Allowance

For most people, the first £12,570 you earn is tax-free. If your total income crosses £100,000, though, that allowance starts to reduce, so keep an eye on that threshold.

Step 3. Apply your Dividend Allowance

After the personal allowance, the first £500 of dividend income is tax-free thanks to the dividend allowance. This applies to everyone, no matter which tax band they fall into.

Step 4. Work out which tax band your dividends fall into

After allowances, your remaining income is split into tax bands. Your dividends are then taxed at the dividend rates for your income level. For 2025/26, the rates are:

- 8.75% for basic rate taxpayers

- 33.75% for higher rate taxpayers

- 39.35% for additional rate taxpayers

Let's understand this through an example.

Dividend Tax Calculation Example

Sarah earns a £9,000 salary from her limited company and takes £20,000 in dividends.

- Total income = £29,000

- Personal Allowance = £12,570

- Dividend Allowance (2025/26) = £500

- Taxable dividends = £19,500

- Since her total income is below £50,270, her dividends are taxed at the basic dividend rate of 8.75%.

- Tax due = £19,500 × 8.75% = £1,706.25

Pro Tip: Calculating your dividend tax manually is honestly more hassle than it’s worth, especially when you’re dealing with multiple income sources. Instead, try GoForma’s free Dividend Tax Calculator. Just enter your details, and it’ll give you a clear breakdown of your tax liability for the 2025/26 tax year, factoring in your personal and dividend allowances as well as the current tax brackets.

How to Report and Pay Tax on Dividends?

It is your responsibility to notify HMRC and pay any taxes owed if your dividends exceed the available allowances. The total amount of dividend income you receive during a tax year determines how you report them.

Dividend Income Up to £10,000

There are two methods to report dividend income if it is less than £10,000.

Through Self Assessment: Just include your dividend income on your self assessment tax return if you have already filed one.

If you don't typically file a return, you must notify HMRC after the tax year ends on April 5 and before October 5. You can do this by either:

- Through your tax code: Tell HMRC to update your tax code, the tax will be automatically deducted from your wages or pension.

- Contact the helpline

If the dividend allowance (£500) covers all of your dividends, you don't need to contact HMRC.

Dividend Income Over £10,000

You are required to file Self Assessment tax return if your dividend income exceeds £10,000.

- Include your dividend income in your return if you have already filed one.

- You must register for Self Assessment by October 5th after the end of the tax year if you don't typically file. For example, you have until October 5, 2026, to register dividends received during the 2025/26 tax year, which ends on April 5, 2026.

Deadlines for Dividend Tax Filing and Payment

- Paper returns: due by 31 October following the end of the tax year.

- Online returns: due by 31 January.

- Tax payment: also due by 31 January. If your bill is more than £1,000, you may also have to make payments on account towards the next year’s tax.

Penalties for Missing Deadlines

Deadlines can be costly to miss:

- Late filing: Even if there is no tax owed, there will be a £100 penalty for late filing. Daily fines start after three months, and the penalties increase at six and twelve months.

- Late payment: 5% penalty if unpaid after 30 days, with further charges at six and twelve months, plus interest on the outstanding amount.

Dividend vs Salary: Which is More Tax-Efficient?

One of the most important decisions for company directors is how to pay themselves: through salary, dividends, or a mix of the two. There are different tax effects for each choice, and the right one can make a big difference in how much money you take home.

For most directors, the best way to pay themselves is to take a small salary of £12,570 (NIC Primary Threshold and standard Personal Allowance of £12,570 per year) and then add dividends to that. This strategy:

- Keeps Income Tax and NICs lower

- Makes use of the personal allowance

- Provides National Insurance credits for state benefits

- Reduces the overall tax burden compared to salary-only income

Many small business owners with limited companies usually prefer this mix of director's salary and dividends because it is thought to be the most tax-efficient

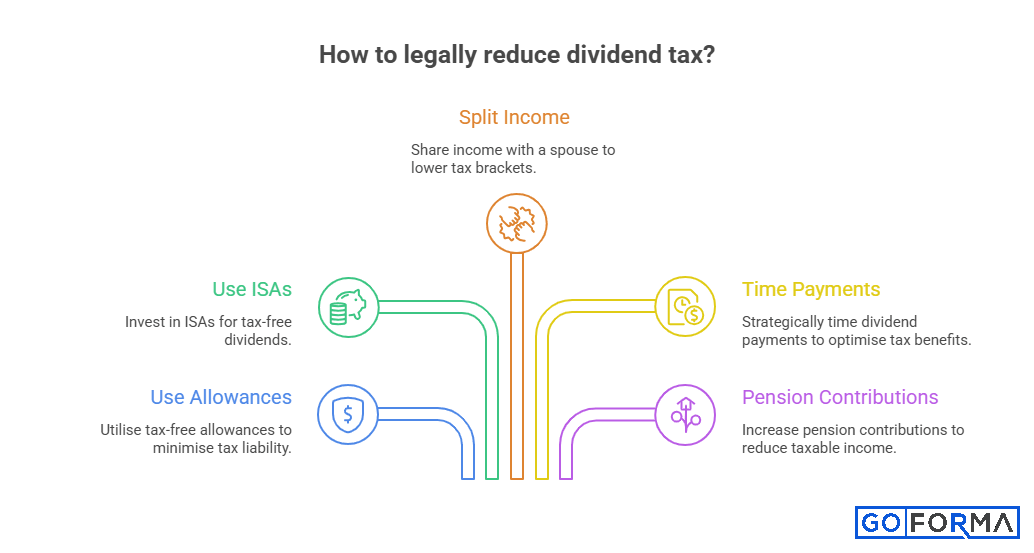

Strategies to Reduce Dividend Tax Legally

No one wants to pay more taxes than they have to. You can't avoid paying dividend tax completely, but there are legal ways to lower your tax bill. You can keep more of your money while still following all of HMRC's rules if you plan your income carefully and use allowances. It's even more important to plan ahead now that the dividend allowance is getting smaller.

1. Make use of your allowances

The first portion of each person's income is covered by their personal allowance, which is typically £12,570. Additionally, there is a Dividend Allowance (£500 in 2025/2026). You can reduce the amount of dividends that fall into taxable bands by structuring your income to fully benefit from these.

2. Use ISAs for Tax-Free Dividends

Regardless of your income, dividends from investments held in an Individual Savings Account (ISA) are entirely tax-free. Because of this, ISAs are among the easiest and most efficient ways to lower dividend tax.

You can invest up to £20,000 in ISAs for the 2025/26 tax year. Your taxable income will not be affected by any dividends you receive within this wrapper.

3. Split Income with a Spouse

You might be able to give your spouse shares if you're married or in a civil partnership, allowing you to both benefit from dividend and personal allowances. If one partner has a lower tax rate, this tactic may work very well.

For example, transferring shares to joint ownership could result in annual dividend tax savings of thousands if one spouse is a basic rate taxpayer and the other is a higher rate taxpayer.

4. Time Your Dividend Payments Wisely

When dividends are paid out can have a significant impact. You might be able to keep more income in a lower tax bracket by deciding whether to pay dividends before or after April 6th, the beginning of the new tax year. For instance, you might prevent your income from moving into a higher band this year by postponing a payment until the following tax year.

5. Pension Contributions

One tax-efficient method of lowering your income tax and dividend tax obligations is to contribute to a pension. Your taxable income may be reduced by pension contributions, which could result in a larger portion of your dividends falling into the basic rate band as opposed to the higher or additional bands. This increases long-term retirement savings in addition to saving taxes now.

Make the Most of Your Dividends with Smart Tax Planning

Dividend tax rules have been shifting quite a bit recently, and, honestly, staying ahead of these changes is non-negotiable if you want to protect your income. The tax-free dividend allowance keeps dropping, so you can’t just expect to pocket dividends tax-free like the good old days. Whether you fall under the basic rate, higher rate, or additional rate bands, each has different rules, and, yes, the difference matters for your bottom line.

If you’re proactive, there’s real value in planning before the tax year wraps up. Take a proper look at your income mix and rethink when you’re drawing those dividends. With a smart strategy, you could reduce your tax bill, keep your cash flow steady, and skip the last-minute stress that gets in the way of running your business.

Don’t be shy about getting professional input. A qualified small business accountant can help you find the most tax-efficient route, make use of every available allowance, and keep you on the right side of HMRC. Their expertise isn’t just reassuring, it can save you money you’d otherwise leave on the table.

Take action now – Book a free consultation with our small business accountant about your dividend strategy and make sure your hard-earned profits work harder for you. It’s a practical move that pays off.

FAQs on UK Dividend Tax

Do I Pay Capital Gains Tax on Shares?

Yes and no. Yes, you may need to pay capital gains tax when you sell shares that have increased in value. But you do not need to pay capital gains tax on shares held within an ISA or pension.

Do I pay dividend tax if my income is under £12,570?

In 2025/26, you get a £500 Dividend Allowance, which lets you receive that amount tax-free. This allowance is separate from and in addition to your £12,570 Personal Allowance. Any dividends over £500 are taxable based on your income level.

What is the dividend allowance for 2025/26 tax year?

The dividend allowance for the 2024/25 and 2025/26 tax year is £500. This means you can receive up to £500 in dividend income without paying any tax.

Are dividends taxed higher than salary?

Dividends are usually taxed at lower rates than salary, but they don’t count towards pension contributions or certain benefits. Many company directors use a mix of both for tax efficiency.

Can I avoid dividend tax legally?

You can’t skip dividend tax altogether, but you can lower it. Using ISAs, pension contributions, and splitting income with a spouse or partner are common legal ways to cut the bill.

Can I use dividend allowance and ISA allowance together?

Yes, you can use both. Dividends held in an ISA are completely tax-free, and you still get the £500 dividend allowance on shares held outside your ISA.

How much can I earn in dividends without paying tax?

In the 2025/26 tax year, you can earn up to £12,570 using your personal allowance plus £500 from the dividend allowance before any tax is due.

What happens if my dividend income crosses into a higher tax band?

If your dividends push your total income into a higher tax band, the portion above the threshold is taxed at the higher dividend rate. Only the amount over the band is charged at the higher rate.

Are dividends taxed differently from salary income?

Yes, dividends are taxed differently from salary. Salary is subject to Income Tax and National Insurance, while dividends are taxed at special dividend rates and don’t attract National Insurance.

Do I pay National Insurance on dividend income?

No, dividends are not subject to National Insurance, which makes them more tax-efficient than salary in many cases.

.png)